Bali’s tourism industry has entered a new phase in 2025, reaching its highest level of international arrivals to date. More importantly, this growth is no longer driven by short-term recovery alone. The island is now demonstrating stable, long-term tourism demand.

For property investors, this creates a solid foundation for consistent rental performance, stronger occupancy rates, and sustainable asset growth, particularly in emerging premium locations such as Cemagi, Bali.

Bali Tourism Growth in 2025: What the Data Shows

Source: https://bali.bps.go.id/en

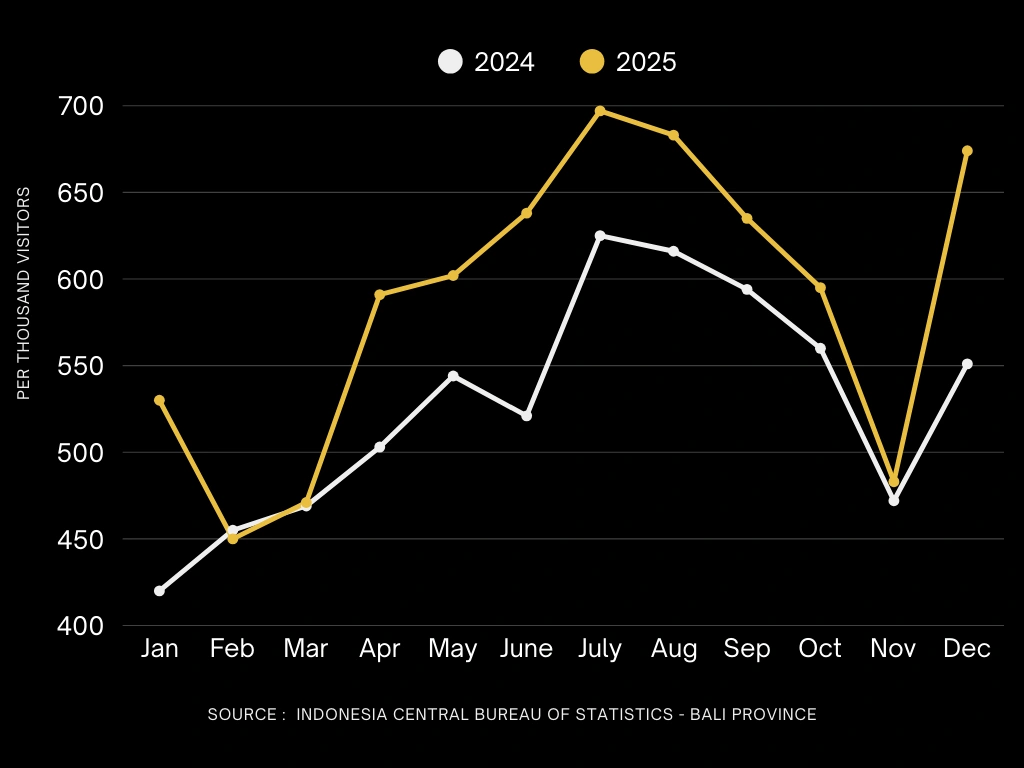

According to data from Indonesia’s Central Bureau of Statistics (Bali Province), international arrivals in 2025 consistently outperform 2024 across most months.

Key Trends Investors Should Pay Attention To

- Steady year-on-year growth throughout the year

- Clear peak season concentration between June and August, with July as the highest month

- Strong visitor numbers even outside traditional peak periods

This pattern confirms that Bali has moved beyond recovery and into sustained tourism growth, which is essential for long-term property investment stability.

Why Tourism Demand in Bali Continues to Grow

Bali’s continued growth is supported by several structural advantages.

Strong Infrastructure and Lifestyle Ecosystem

Bali combines reliable infrastructure with a fully developed lifestyle offering, including:

- Professional hospitality services

- Dining, wellness, and entertainment options

- International-standard accommodation

Easy International Access

With extensive global flight connectivity, Bali remains one of the most accessible destinations in Southeast Asia, supporting consistent international demand.

What This Means for the Future of Bali Tourism

Looking ahead, Bali is shifting into a more balanced and resilient tourism model, defined by:

- Demand spread more evenly across the year

- Stronger and more predictable peak seasons

- Growing focus on quality locations and professionally managed projects

For investors, this means lower volatility and stronger long-term fundamentals.

What Bali’s Tourism Growth Means for Property Investors

More Consistent Cashflow

A stable tourism market typically results in:

- More even occupancy throughout the year

- Reduced dependence on peak seasons alone

- Predictable monthly rental income

Rising Demand for Well-Managed Properties

Today’s travelers increasingly prefer properties that offer:

- Professional management

- High design and build quality

- Locations that balance privacy, accessibility, and lifestyle

This trend clearly favors strategic developments over speculative projects.

Cemagi, Bali: A Strategic Location for Long-Term Investment

Cemagi is emerging as a premium yet low-density area that appeals to modern travelers and long-term investors alike. The area offers:

- A quieter environment compared to crowded tourist zones

- Close proximity to Bali’s main lifestyle hubs

- Limited supply of high-quality developments

These factors support long-term capital appreciation and rental resilience.

Zen Luxury Complex

Discover now: https://remarc.group/zen-luxury-complex

Developed by Ramarc Property Group, Zen Luxury Complex in Cemagi is designed to align with Bali’s evolving tourism landscape.

Key investment highlights:

- Apartment and villa units tailored to current market demand

- In-house management, ensuring operational consistency

- A structure focused on stable and reliable investor cashflow

Zen Luxury Complex is positioned as a lower-risk, professionally managed investment, suitable for investors seeking long-term value rather than short-term speculation.

A Market Built for Long-Term Investors

Bali’s tourism performance in 2025 confirms a critical shift toward sustained, long-term growth. This environment supports:

- Stronger occupancy rates

- More consistent rental income

Improved long-term asset value

By focusing on quality locations such as Cemagi and professionally managed developments like Zen Luxury Complex, investors can position themselves to benefit from the future of Bali’s tourism-driven property market.

Published by