Understanding the most misunderstood investment model in Bali

Leasehold is often seen as a less valuable form of ownership by many foreign investors entering the Bali property market. This perception is based on assumptions, not on legal reality, not on financial performance, and not on actual risk.

In reality, leasehold is the safest, most legal, most efficient, and most profitable ownership structure available to foreign investors in Indonesia.

This article provides a clear and objective explanation of why leasehold is a strategic choice for modern investors who prioritize profitability, compliance, and long term security.

1. The Common Misconception: “If you do not own the land, the value is lower.”

The most widespread misunderstanding about leasehold is the belief that not owning the land reduces the investment value. In practice, the land itself does not generate income. The income comes from the villa’s operational performance.

Leasehold provides several important advantages.

Full operational control

Investors gain complete rights to operate, rent out, and generate income from the property during the entire lease period.

Lower entry cost

Instead of paying a premium for land ownership, investors pay only for the income generating asset. This reduces initial investment and improves efficiency.

Higher return on investment and faster payback

Lower capital requirements combined with strong rental demand create faster investment recovery and stronger annual returns. In simple terms, many people focus on the land, not on the performance. Long term profit comes from income, not titles.

Source: The Bali Lawyer

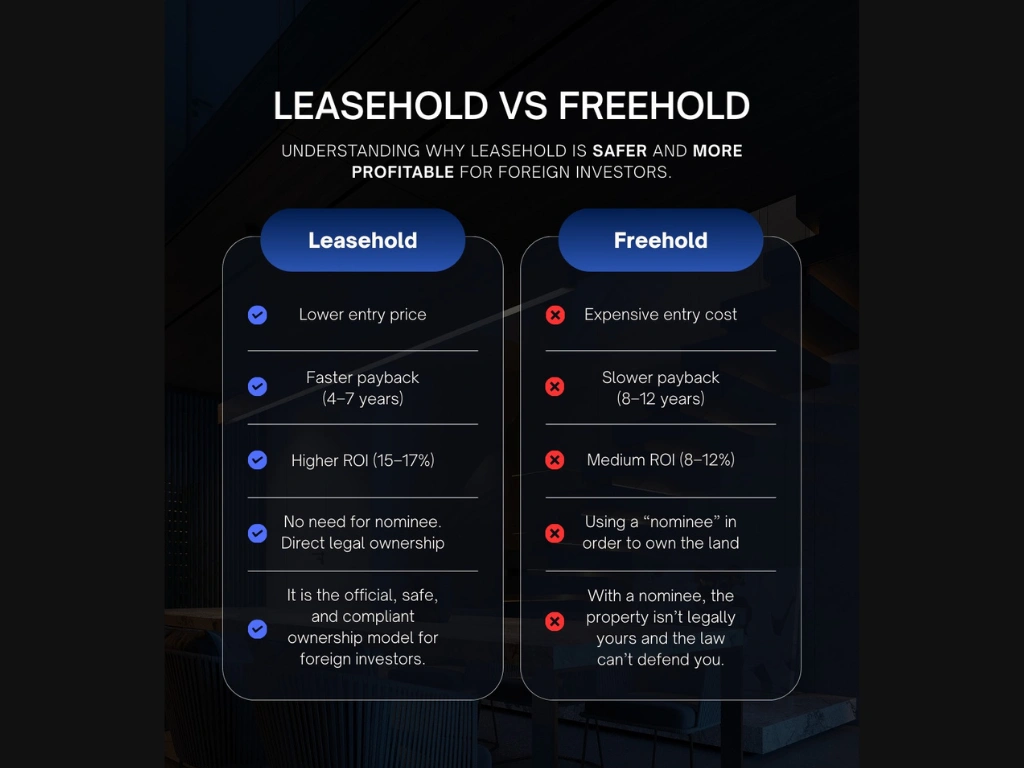

2. Leasehold vs Freehold: A pragmatic comparison for foreign investors

A clear comparison helps investors understand which structure offers better profitability and lower risk.

Leasehold

- Entry cost is lower which improves capital efficiency.

- Payback period is faster between four and seven years which reduces exposure to risk.

- Return on investment is higher between 15-17%.

- No nominee is required which means foreign investors receive direct legal usage rights.

- Fully legal and compliant with zero potential for ownership disputes.

Freehold through nominee

- Entry cost is significantly higher and reduces efficiency.

- Payback period is slower between eight and twelve years.

- Return on investment is moderate between 8-12%.

- A nominee must be used which means the investor does not legally own the property.

- High legal vulnerability because nominee relationships cannot be defended in court.

Objective conclusion:

Leasehold is the only ownership model that is fully safe and compliant for foreign investors in Indonesia.

3. The Myth That Misleads Investors

Many foreign investors avoid leasehold simply because they do not fully understand how it works. The facts tell a different story.

- Leasehold is legal, safe, efficient, and historically provides the strongest financial results in Bali’s villa market.

- Freehold for foreigners is only possible through nominee structures which are risky, fragile, expensive, and inefficient.

- When comparing legal clarity, operational control, capital efficiency, and return on investment, the conclusion becomes obvious.

- Leasehold is safe, legal, profitable, low risk, and highly efficient.

- Freehold through nominee is legally uncertain, requires more capital, and produces slower returns.

Source: Smart Advisory Solutions Bali

4. Why Leasehold Outperforms in Bali’s Real Estate Market

Leasehold consistently produces better results due to these three fundamental factors.

Market performance

Bali is a revenue driven market. The value of an investment is defined by rental income, not by the ownership of land.

Legal compliance

Indonesian law provides a clear and legitimate framework for leasehold as the correct structure for foreign participation.

Capital efficiency

Lower upfront investment allows investors to achieve stronger returns with faster recovery periods. In short, leasehold maximizes profit without exposing investors to unsafe or illegal ownership structures.

What This Means for You as an Investor

For foreign investors in Bali, leasehold is not a second-best option. It’s simply the only legal ownership that works. At Remarc Property Group in Cemagi, our complex is built on a 100% legal leasehold structure, fully compliant with Indonesian law. There are no nominee setups and no legal shortcuts. You get clear contracts, full rights to operate the property, and the ability to earn rental income with confidence.

In reality, successful investing in Bali isn’t about owning land. It’s about owning a well-performing asset. Leasehold allows you to invest more efficiently, reduce unnecessary risk, and focus on what actually matters : income, stability, and long-term returns.

For investors who value clarity, safety, and real performance, leasehold remains the most practical and proven approach in Bali’s property market.

Published by