Indonesia is entering a new phase of investment-driven economic expansion. After moving past the pandemic, the country has transitioned from recovery to acceleration, recording some of the strongest foreign inflow growth in its modern history.This shift reflects rising confidence from global investors who now view Indonesia as a stable, scalable, and strategically important market in Asia.

Government reforms have played a central role. Simplified licensing, the Omnibus Law, tax incentives, and major infrastructure projects have reduced operational barriers and improved the overall investment climate. With new industrial zones, upgraded logistics networks, and stronger digital infrastructure, Indonesia is building the capacity required for long-term, sustainable economic growth.

These developments are reshaping key sectors such as manufacturing, services, energy, mining downstream, and real estate. The impact is especially visible in high-demand regions like Bali, where improved connectivity and rising international interest continue to push rental demand and asset values. Indonesia’s momentum is structural, not temporary positioning the country as one of Asia’s most competitive and promising investment destinations.

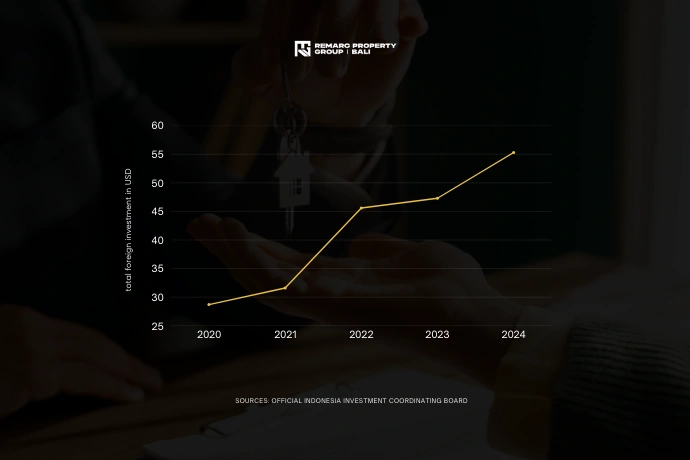

FOREIGN INVESTMENT DATA: 2020 – 2025

Indonesia’s foreign direct investment increased steadily from USD 28.7 billion in 2020 to USD 55.3 billion in 2024. This represents a near-doubling of investment inflow in four years. The consistent rise shows that international investors see Indonesia not as a risky emerging market, but as a stable long-term growth environment.

By Q3 2025, Indonesia had already secured USD 39 billion in foreign investment. This puts the country on track to match or exceed last year’s performance. The pace indicates that even global economic uncertainties have not slowed investor appetite for Indonesia.

The investment surge is supported by policy improvements such as the Omnibus Law, simplified licensing, Special Economic Zones (SEZs), and tax incentives for manufacturing and technology sectors. These reforms remove barriers, reduce bureaucracy, and make Indonesia significantly more attractive for foreign capital.

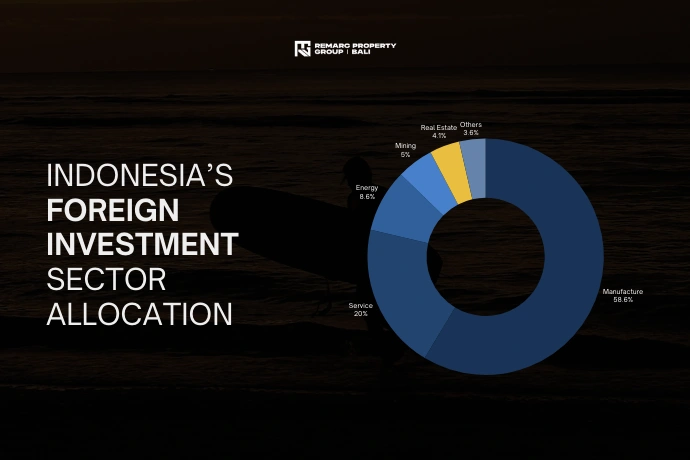

FOREIGN INVESTMENT – SECTOR ALLOCATION

Indonesia’s foreign investment is shifting toward higher-value industries. Manufacturing leads growth through expanding industrial capacity, while the service sector strengthens with rising activity in logistics, finance, tourism, and digital services. Energy and mining remain strategic pillars, and real estate continues to attract steady investor interest. The rest flows into emerging sectors that support broader economic diversification.

WHAT THIS MEANS FOR INVESTOR

Increasing foreign investment creates direct, practical benefits for property investors — especially in Bali, Indonesia’s main international destination:

- Improved National Infrastructure

Foreign investment accelerates infrastructure development: new roads, modernized airports, improved waste systems, upgraded power networks, and digital infrastructure expansion. Bali directly benefits from these improvements, making it more accessible and more livable for long-term tourists and expats. - More International Connectivity

New international routes and increased flight frequency reduce travel friction. This expands Bali’s reach to Europe, the Middle East, and Asia-Pacific markets, creating steady demand for accommodations throughout the year—not just during peak season. - Rising Expat Population and Long-Stay Tourism

As Indonesia becomes more globally recognized, expats, digital nomads, and long-stay visitors are choosing Bali as their base. This strengthens year-round rental demand, stabilizing occupancy rates for property owners. - Stronger Rental Income and Better Yield Stability

Higher occupancy directly impacts rental revenue. Properties in prime areas such as Cemagi, Seseh, Bingin, and Canggu continue to record strong performance. Investors benefit from reliable passive income supported by market fundamentals, not speculation. - Increasing Property Values Over Time

As infrastructure improves and demand rises, land and property prices in Bali show upward movement year after year. Foreign capital reinforces this trend by fueling new developments and increasing local economic activity. - Lower Investment Risk Compared to Other Regions

Indonesia’s combination of economic reforms, demographic strength, and tourism resilience makes it less volatile than markets dependent on a single sector. Bali’s real estate market, supported by both tourism and long-term living trends, offers a diversified risk profile.

CONCLUSION

Indonesia’s surge in foreign investment shows a clear move into a stronger and more confident economic phase. For investors especially those looking at Bali the impact is straightforward. Demand keeps rising, occupancy remains strong, rental returns are improving, and property values continue to trend upward. With the country’s steady momentum and ongoing reforms, Bali stands out as one of the most reliable and strategic real estate investment locations in the Asia Pacific region.

Published by