- HOME

- ARTICLES

Bali’s Transformation Into Asia’s Next Financial Hub: From Paradise to Powerhouse

- October 14, 2025

- Articles

Bali, Indonesia – October 14, 2025

Remarc Group – Premium Real Estate and Investment Opportunities in Bali

Bali, long celebrated as the jewel of Southeast Asia for its natural beauty and rich culture, is now poised to become something much greater, a regional financial powerhouse. Under the leadership of President Prabowo Subianto, Indonesia is embarking on an ambitious plan to transform Bali into a modern, globally connected financial hub that rivals Dubai and Singapore.

Source: South China Morning Post

The Bali initiative comes as Indonesian officials try to reignite growth amid weakening investment and declining consumer confidence. The country’s richest businessmen are also growing wary of Prabowo’s attempts to crack down on inequality.

The initiative, which involves the finance ministry and the National Economic Council, has support from Bridgewater Associates founder Ray Dalio, who informally advises the president.

“The government wants to create a modern, transparent financial centre that supports national economic development,” Jodi Mahardi, spokesman for the economic council, said when asked about the plan.

“It is expected to become a platform that connects global investment with real opportunities in Indonesia’s real sector,” he said, without elaborating.

The government’s blueprint aims to turn Bali into a world-class center where international banks, investors, and billionaires converge. This plan is not just about prestige; it’s a cornerstone of Indonesia’s broader economic reform designed to attract foreign capital, streamline regulations, and diversify beyond tourism.

Drawing inspiration from the Dubai International Financial Centre (DIFC) and India’s GIFT City, the Bali financial hub will focus on transparency, simplified taxation, and ease of doing business. These measures are expected to position Indonesia as a top destination for financial services, wealth management, and fintech innovation across Asia.

Fueling Indonesia’s Economic Ambitions

To achieve its 8% economic growth target by 2029, Indonesia aims to attract around 13,000 trillion rupiah (USD 784 billion) in investment within the next four years. Much of this capital will flow into infrastructure, technology, and financial services, driving both national and regional development.

The Bali financial hub will act as a gateway for global capital, connecting investors directly to Indonesia’s expanding sectors from green energy to digital finance and property development. This transformation also aligns with the country’s long-term vision to reduce reliance on resource exports and instead position itself as a regional center for innovation and investment.

Bali’s Strategic Advantage

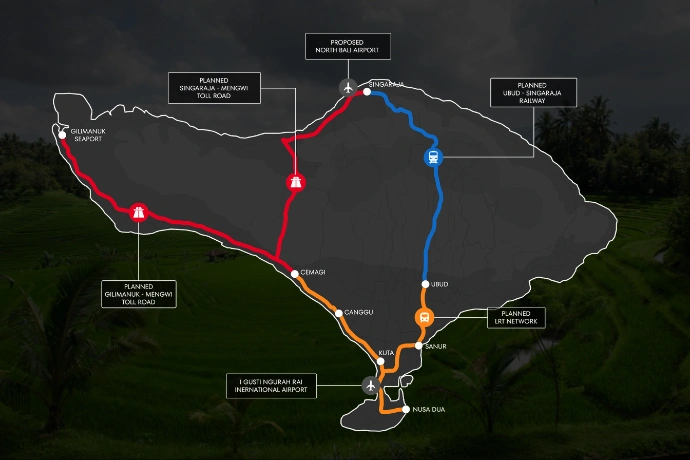

Beyond policy incentives, Bali’s appeal lies in its unique blend of lifestyle and location. The island already hosts a thriving community of global entrepreneurs, digital nomads, and investors. With world-class resorts, international schools, and improved infrastructure — including the upcoming North Bali Airport and a planned metro connection from the airport to Cemagi — the island is perfectly positioned to evolve from a tourism paradise into a global business ecosystem.

The creation of a financial district would further elevate Bali’s real estate market, creating new opportunities for developers, investors, and high-net-worth individuals seeking both returns and lifestyle benefits.

If successful, the “Financial-Hub Bali” project will mark a historic shift. Transforming the island’s image from a vacation destination to a hub of international finance and sustainable growth.

By bridging global capital with Indonesia’s dynamic economy, Bali could soon become the beating heart of Southeast Asia’s investment landscape — where paradise meets prosperity.

- 2025 | All Rights Reserved.